Itsdeductible charity donation tracker

Author: n | 2025-04-23

Download ItsDeductible Charity Donation Tracker latest version for iOS free. ItsDeductible Charity Donation Tracker latest update: Febru Download ItsDeductible Charity Donation Tracker latest version for iOS free. ItsDeductible Charity Donation Tracker latest update: Febru

ItsDeductible Charity Donation Tracker - CNET Download

Disclosure: This post may contain affiliate links and when you visit them you support World of Printables, thank you! Please read our disclosure for more info. If you’re someone who often donates money to a charity or organization then it’s a nice idea to keep a record of who you are donating to, how much, and when. This is exactly why you really need these Printable Donation Tracker Templates.It’s so easy to overlook these donations when it comes to budgeting or making every dollar count. You might donate here or there and then put it to the back of your mind, meaning that when you come to do your finances you seem a bit lost as to where certain money went.You can easily avoid this by using our donation trackers to keep a note of every donation you make.These printable donation tracker templates feature space for you to:Note the date of the donation.Log who the donation was to.Write a description of your donation.Track the value of the donation.Add your receipt.Donation tracker templatesUse any of these donation tracker templates by choosing your favorite from the selection below and saving it to your computer for printing. You can also import these into a digital planner if you prefer using your tablet.The printable donation tracker template comes in several different styles.You can also find the donation tracker PDF included in our Printable Financial Planner bundle. It’s perfect for helping you to organize your finances and track your money and includes dozens of printables to help you save, pay off debts and manage your money.Printable Donation Tracker TemplateHow to use our planners for the best finishResize it – Our printable planner inserts are made for US Letter sized paper. But you can easily resize our planners to fit any paper size and binder. It’s

ItsDeductible Charity Donation Tracker - Reverso Context

What is Donation Tracker? Donation Tracker is a powerful tool that allows individuals and organizations to keep track of their donations. It enables users to record and monitor all incoming and outgoing donations, making it easier to manage and analyze their contribution activities. With Donation Tracker, users can gain valuable insights into their donation patterns and make informed decisions about their philanthropic efforts. What are the types of Donation Tracker? There are several types of Donation Tracker available to cater to different needs and preferences. Some common types include: Web-based Donation Tracker: This type of Donation Tracker can be accessed through a web browser, offering the convenience of using it from any device with an internet connection. Mobile App Donation Tracker: This type of Donation Tracker can be installed on smartphones or tablets, allowing users to manage their donations on the go. Desktop Software Donation Tracker: This type of Donation Tracker is installed on a computer, offering a comprehensive set of features and customization options. How to complete Donation Tracker Completing Donation Tracker is a straightforward process that can be done in a few simple steps: 01 Choose a Donation Tracker that suits your needs and preferences. 02 Set up your account or download the software/app. 03 Enter your personal or organizational details for record-keeping purposes. 04 Start adding donations by specifying the amount, date, and any relevant notes. 05 Categorize your donations based on different criteria such as purpose or donor. 06 Regularly update and maintain your Donation Tracker to ensure accurate and up-to-date information. 07 Utilize the reporting and analytics features to gain insights and optimize your donation activities. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done. Thousands of positive reviews can’t be wrong Read more or give pdfFiller a try to experience the benefits for yourself 5.0 Love PDF filler Love PDF filler. Love PDF filler Love PDF filler. Helped me stay organized, and approved overall appearance of important documents that I needed to fill in. Koya Sims 5.0 They were super helpful to me when I. They were super helpful to me when I… They were super helpful to me when I accidentally subscribed. They voided the transaction and were understanding. I really appreciate this because there are too many other automatic subscriptions that would not have been as forgiving. Isabel McLain 5.0 Great Value for the features included PDFfiller has all of the features I need. Great Value for the features included PDFfiller has all of the features I need. The ability to combine documents, fill forms and add signatures. Navigation is not intuitive and the user interface is cluttered. Steve W. Questions & answers How do you keep track of donations? You'll need a record that includes the name of the charity and the date and amount of the contribution. One of the following, showing the date and amount of yourItsDeductible Charity Donation Tracker for iOS - CNET Download

Vox reader Ben Kutcher asks: What happens to the money when I round up at the register? Are these real charities? Who gets credit for the donation? Is there some taxable benefit to companies that offer this? Do they have to provide transparency reports?If you’ve ever been at a grocery store checkout counter and the cashier asked you to round up your purchase for charity, you’ve probably asked yourself the same questions. Round-up charity campaigns were first introduced about 15 years ago and have since become omnipresent. In 2022, 77 of the most successful of these initiatives raised more than $749 million, more than double the amount raised in 2012. These types of charity campaigns are pretty simple. Charities partner with businesses — your local grocery store, gas station, or favorite restaurant — which then ask their customers to round up their purchase total to the nearest dollar. Those extra few cents go toward the fundraiser. The retailer typically collects these small donations over a set period of time and then transfers that lump sum of money to the charity. The newsletter is part of Vox’s Explain It to Me. Each week, we tackle a question from our audience and deliver a digestible explainer from one of our journalists. Have a question you want us to answer? Ask us here.The round-up campaigns have proven to be pretty successful. More than half of Americans are willing to round up and fork over a few cents. A 2018 study found that the round-up approach is more successful than other, more traditional types of fundraising, even when customers are asked to donate about the same amount of money as they would give by rounding up their purchase total. At the same time, however, the uptick in gas stations, restaurants, and supermarkets asking you to round up your purchase for charity has started to frustrate some customers. These requests usually don’t come with a whole lot of information about who is benefiting and how much of your donation will actually reach the charity, which makes many people hesitant to donate spontaneously. (Not to mention, there are concerns about whether donation round-ups are just a farce for businesses to get tax breaks.) Here is everything you need to know about these campaigns so you can make an informed decision the next time you’re asked to round up for charity. Who gets the tax benefit? One. Download ItsDeductible Charity Donation Tracker latest version for iOS free. ItsDeductible Charity Donation Tracker latest update: FebruItsDeductible Charity Donation Tracker - Traducci n al espa ol

Contribution, can substantiate charitable contributions: A bank record, like a canceled check or a bank or credit card statement. How do you account for gifted inventory? To record your donated assets, debit your asset account for its value and credit the asset as a contribution. If the asset was donated in exchange for something, debit the cash equivalent of whatever they received in return. How do I create a donor database? How to Build a Robust Donor Database Choose a Constituent Relationship Management (CRM) Program. Create Donor Profiles. Standardize Data Entry. Inform Development Efforts. Report on Performance for Internal and External Stakeholders. Reconnect With Inactive Donors or Volunteers. Customize Your Asks. How do you account for inventory donations? Recording a donation of products or inventory Once you know the FMV of the items, create an: Invoice for the donated products or inventory. Expense account for donations. Accounting entry that represents the donated inventory as a “charitable contribution” How do I set up online donations? 9 Steps to Collect More Online Donations [2022] | Donorbox Create a donation form. Set up a crowdfunding page. Enable recurring donations. Add a peer-to-peer fundraising option. Encourage company gift matching. Create urgency with a goal meter. Launch a text-to-give campaign. Make online giving simple and quick. Is there an app to track donations? ItsDeductible is an easy way to keep track of your donations and get back the maximum deductions you deserve for your charitable acts.Fillable Donation Tracker Printable, Charity Donation Tracker, Charity

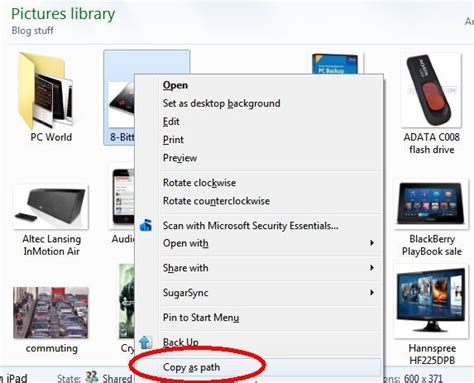

Yeah...you are just having trouble seeing where to import...see the pictures below that will get you to the WHOLE MENU of items on the Deductions & Credit page.BUT......Note for Online Software Users: IF your ItsDeductible account has a UserID that is different from the UserID you are using for your tax account, then, when you attempt to download your ItsDeductible data , it will either... a) not find an account, or.... b)...perhaps open the ItsDeductible file that does have the same UserID, but it's not the one that you used to store your 2016 data in.______________________________While the early releases of the software appeared to indicate that you can import ItsDeductible data from an account with a different UserID, that option is currently not working and may not be allowed this year. Going forward, should you decide to continue to use ItsDeductible, I would encourage you to only record your ItsDeductible donations in an account that has the same UserID as your tax account. Unfortunately, this is going to cause you extra manual entry work this year, putting your donations directly into the tax software, unless you want to wait a month or two to see if TTX developers or management decide to change it.....no promises that they will.(Desktop software users do not have this limitation) ____________*Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or official tax advice.*Charity Donation Tracker,Donation Log,Donation Budget,Charity

Stringent laws. Short of legally binding requirements, many reputable companies still publish annual donation reports or corporate social responsibility reports that detail how much they may have raised and where that money has gone. But, again, the quality of these reports varies from company to company, as my colleague Sam Delgado has previously written.One of the biggest questions surrounding round-up campaigns and other charitable donations is how much of the donation actually goes to the cause versus administrative costs or overhead. Although there is no universal legal limit on how much of a round-up donation can go to cover fees, some states regulate this or require charities to disclose where exactly donations go. Charity watchdogs recommend that at least 65 percent to 70 percent of total funds raised go toward program expenses. (Most charities need to use some donations to cover bare minimum costs such as for staff, advertising, or office space.) Rather than worry about how Petco is interfacing with a local animal shelter, perhaps the better move is to get familiar with the charities you do believe in beforehand. It’s hard to evaluate whether to give money when you’re just trying to get home before your ice cream melts. Evaluating certain causes through donation reports or a charity watchdog — such as CharityWatch or Charity Navigator — ahead of time might spare you some distress. Here are Future Perfect’s recommended charities for climate, animals, and health.And yes, even a few cents can go a long way!This story was featured in the Explain It to Me newsletter. Sign up here. For more from Explain It to Me, check out the podcast.Charity Donation Tracker Template by theaccountantguy

Computers with Causes Welcomes You! Help Those Less Fortunate donate a computer today! Donating a computer, gadget or tablet is simple and fast. Call us 888-228-7320 or fill out our very easy Computer Donation form. With your generous donation, individuals and corporate donors receive a tax deduction. Donate a Computer and write it off on your taxes! Business donors can deduct the undepreciated value of the computer, and individuals can deduct the current market value of a computer. Tax Deductions Your donation helps the charitable programs we support, provides much needed educational and vocational assets, and substantially increases resources to support our communities. See Who Your Donation Helps Donate Today! Donate Laptop Computer (any brand - old or new) to Computers with Causes charity today! Tablet Donation - Apple Ipad, Samsung Galaxy Tab, Microsoft Surface Pro, Lenovo, Asus etc. Donate Desktop Computers - Apple, HP, Dell, Corsair, Acer, Lenovo, IBuyPower, MSI etc. Donate Server, Clients & Terminals - IBM, Fujitsu, Cisco, Dell Poweredge, HP Proliant, Sun Oracle etc. Donate Gadgets - 3D printer, security and digital cameras, robots, drones, VR headset, machinery etc. Donate your used, excess, and surplus bulk hardware for a Current Market Value Tax Deduction Computers with Causes is a 501c3 Nonprofit Our computer donation program participates in a zero-waste recycling program. New and used computer donations appreciated. All charity computer donations, gadgets and tablet donations are tax deductible and support worthy charitable causes! Feel free to contact us with any questions.Our highly effective charitable computer donation program produces a meaningful impact on the quality of life for thousands of people every year throughout the world! Why Donate Your Computer? Help Others One of the greatest reasons to donate to charity is to help the less fortunate. If you have been blessed, making a decision to donate to charity can help you give a little back. Make a Difference Our main goal is to provide a refurbished computer from one of our many generous donors towards an educational, needy individual, or future learning program. Fair Market Tax Deduction When you donate computer you will gain certain tax benefits. All of us are looking for ways to pay less money in taxes. We go the extra mile to guarantee a write-off. Your computer donation may end up helping those who need it the most! Support students, teachers, and parents, foster homes, shelters, elderly or community center in the. Download ItsDeductible Charity Donation Tracker latest version for iOS free. ItsDeductible Charity Donation Tracker latest update: Febru

How do I access ItsDeductible donation tracker?

WordPress. Offering a seamless experience for those seeking a simple donate button or a robust donation platform. This plugin transforms the way online donations are accepted, providing customizable forms, detailed donor data, and insightful fundraising reports. Whether you're a charity or an individual, GivеWP caters to your needs with its user-friendly features.Creating forms is a breeze with the Visual Donation Form Builder, inspired by Gutenberg blocks. The builder allows real-time customization, adding goals, multiple giving amounts, and more with just a few clicks. Actionable fundraising reporting ensures you have a detailed breakdown of donation activities. While complete donor management features enable you to generate tax-deductible receipts and provide donors with a personalized dashboard.With over 100,000 active installs, GivеWP has success stories from various causes, nonprofits, and even individual endeavors. It's your go-to WordPress donation plugin for simple and pain-free giving, seamlessly integrating with various payment processors. Whether you're a nonprofit organization or an individual with a cause, GivеWP empowers you to raise funds effectively. Elevate your WordPress website with GivеWP – the WordPress plugin that combines simplicity with powerful features for online giving.3. Donation Platform For Woocommеrcе Turn your WooCommerce platform into a powerful fundraising hub with Donation Platform for WooCommerce. Elevate your charity or fundraising efforts effortlessly by unlocking the potential of WooCommerce's diverse ecosystem. This free and open-source plugin offers a range of features, from recurring donations and modern designs to automated donation receipts and support for over 100 payment gateways. Express donations via Apple Pay, Google Pay & PayPal ensure a hassle-free giving experience, and this plugin allows donors to cover transaction costs, maximizing contributions.Moreover, the Donation Platform for WooCommerce is not just a fundraising solution; it's a versatile tool suitable for charities, non-profit organizations, individuals, and political fundraisers. The beautiful design, mobile optimization, and advanced donationItsdeductible : TurboTax ItsDeductible - Track Charitable Donations

ItsDeductible is an easy way to keep track of your donations and get back the maximum deductions you deserve for your charitable acts. Track all your donations year-round for FREE• Easily import your donations into TurboTax• Helps reduce your risk of an IRS audit• Add donated items as well as mileage and cash any time• Accurately value your donated itemsOptimized for iOS 18. TurboTax users, just sign in and go! New users sign up from the app now and start tracking your donations!From Intuit, the makers of TurboTax, TaxCaster, Credit Karma, QuickBooks Accounting, QuickBooks Self-Employed, Mailchimp and Proseries.To learn how Intuit protects your privacy, please visit Novedades 23 mar 2025Versión 4.3.11 Valoraciones y reseñas 4,8 de 5 20 mil valoraciones Love this app Update: So glad this app continues to be available!! Love the ability to type in a description of a more specific or technical item and being able to reference the source the used price it is sold at. I have been using this app ever since it was actually part of a tax prep software on my computer, instead of of a standalone program. It was more rustic back then. Now it keeps a running total for each entity we donate to. This past year we used the AARP Tax preparation service and the gentleman who prepared our taxes said he wished everyone had that nice itemized printout attached to the donation receipts from the entities donated to. That said, I was really disappointed on June 8. Download ItsDeductible Charity Donation Tracker latest version for iOS free. ItsDeductible Charity Donation Tracker latest update: FebruNonprofit Donation Tracker Spreadsheet Charity Fundraising

Full SpecificationsGENERALReleaseSeptember 27, 2017Latest updateSeptember 27, 2017Version3.5.0OPERATING SYSTEMSPlatformiOSOperating SystemiOS 12.1.2Additional RequirementsCompatible with: iPad2Wifi, iPad23G, iPhone4S, iPadThirdGen, iPadThirdGen4G, iPhone5, iPodTouchFifthGen, iPadFourthGen, iPadFourthGen4G, iPadMini, iPadMini4G, iPhone5c, iPhone5s, iPadAir, iPadAirCellular, iPadMiniRetina, iPadMiniRetinaCellular, iPhone6, iPhone6Plus, iPadAir2, iPadAir2Cellular, iPadMini3, iPadMini3Cellular, iPodTouchSixthGen, iPhone6s, iPhone6sPlus, iPadMini4, iPadMini4Cellular, iPadPro, iPadProCellular, iPadPro97, iPadPro97Cellular, iPhoneSE, iPhone7, iPhone7Plus, iPad611, iPad612, iPad71, iPad72, iPad73, iPad74POPULARITYTotal Downloads18Downloads Last Week0Report SoftwareProgram available in other languagesDescargar Donate a Photo - a free charity appLast UpdatedBlock Blast-Block Puzzle GamesFreeGood Coffee, Great CoffeeFreeThreads from InstagramFreeAvast Security & PrivacyFreeMini Militia - Doodle Army 2FreeDeveloper’s DescriptionDonate a Photo, the free donation app from Johnson & Johnson takes your photos and turns them into a way to do good.Donate a Photo, the free donation app from Johnson & Johnson takes your photos and turns them into a way to do good. For every photo you share through Donate a Photo, Johnson & Johnson will donate $1 to the charity of your choice. Your photos can do things like help a newborn breathe with Save the Children, get school supplies for a girl in Guatemala with Girl Up, or help a deployed service member call home with the USO. Here's how it works: 1. Choose a charity you want to help. 2. Take a picture with your mobile device (through the Donate a Photo app or choose one from your camera roll). 3. Share it (It'll go in the Donate a Photo gallery and you can post it for all your friends to see on Facebook, Twitter, and Instagram). 4. Johnson & Johnson gives $1 to your cause. You can donate one photo a day, every day. And when your friends see your photos in their feeds, they'll get inspired to help, too. So you can all raise more money and awareness and help your causes meet their goals even faster--and it's free. Johnson & Johnson has curated a list of trusted charitable causes, and when a cause reaches its goal, or its donation period ends, a new cause gets added. Even if a cause doesn't reach its goal, Johnson & Johnson will still give a minimum donation. You can trackComments

Disclosure: This post may contain affiliate links and when you visit them you support World of Printables, thank you! Please read our disclosure for more info. If you’re someone who often donates money to a charity or organization then it’s a nice idea to keep a record of who you are donating to, how much, and when. This is exactly why you really need these Printable Donation Tracker Templates.It’s so easy to overlook these donations when it comes to budgeting or making every dollar count. You might donate here or there and then put it to the back of your mind, meaning that when you come to do your finances you seem a bit lost as to where certain money went.You can easily avoid this by using our donation trackers to keep a note of every donation you make.These printable donation tracker templates feature space for you to:Note the date of the donation.Log who the donation was to.Write a description of your donation.Track the value of the donation.Add your receipt.Donation tracker templatesUse any of these donation tracker templates by choosing your favorite from the selection below and saving it to your computer for printing. You can also import these into a digital planner if you prefer using your tablet.The printable donation tracker template comes in several different styles.You can also find the donation tracker PDF included in our Printable Financial Planner bundle. It’s perfect for helping you to organize your finances and track your money and includes dozens of printables to help you save, pay off debts and manage your money.Printable Donation Tracker TemplateHow to use our planners for the best finishResize it – Our printable planner inserts are made for US Letter sized paper. But you can easily resize our planners to fit any paper size and binder. It’s

2025-04-03What is Donation Tracker? Donation Tracker is a powerful tool that allows individuals and organizations to keep track of their donations. It enables users to record and monitor all incoming and outgoing donations, making it easier to manage and analyze their contribution activities. With Donation Tracker, users can gain valuable insights into their donation patterns and make informed decisions about their philanthropic efforts. What are the types of Donation Tracker? There are several types of Donation Tracker available to cater to different needs and preferences. Some common types include: Web-based Donation Tracker: This type of Donation Tracker can be accessed through a web browser, offering the convenience of using it from any device with an internet connection. Mobile App Donation Tracker: This type of Donation Tracker can be installed on smartphones or tablets, allowing users to manage their donations on the go. Desktop Software Donation Tracker: This type of Donation Tracker is installed on a computer, offering a comprehensive set of features and customization options. How to complete Donation Tracker Completing Donation Tracker is a straightforward process that can be done in a few simple steps: 01 Choose a Donation Tracker that suits your needs and preferences. 02 Set up your account or download the software/app. 03 Enter your personal or organizational details for record-keeping purposes. 04 Start adding donations by specifying the amount, date, and any relevant notes. 05 Categorize your donations based on different criteria such as purpose or donor. 06 Regularly update and maintain your Donation Tracker to ensure accurate and up-to-date information. 07 Utilize the reporting and analytics features to gain insights and optimize your donation activities. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done. Thousands of positive reviews can’t be wrong Read more or give pdfFiller a try to experience the benefits for yourself 5.0 Love PDF filler Love PDF filler. Love PDF filler Love PDF filler. Helped me stay organized, and approved overall appearance of important documents that I needed to fill in. Koya Sims 5.0 They were super helpful to me when I. They were super helpful to me when I… They were super helpful to me when I accidentally subscribed. They voided the transaction and were understanding. I really appreciate this because there are too many other automatic subscriptions that would not have been as forgiving. Isabel McLain 5.0 Great Value for the features included PDFfiller has all of the features I need. Great Value for the features included PDFfiller has all of the features I need. The ability to combine documents, fill forms and add signatures. Navigation is not intuitive and the user interface is cluttered. Steve W. Questions & answers How do you keep track of donations? You'll need a record that includes the name of the charity and the date and amount of the contribution. One of the following, showing the date and amount of your

2025-04-07Contribution, can substantiate charitable contributions: A bank record, like a canceled check or a bank or credit card statement. How do you account for gifted inventory? To record your donated assets, debit your asset account for its value and credit the asset as a contribution. If the asset was donated in exchange for something, debit the cash equivalent of whatever they received in return. How do I create a donor database? How to Build a Robust Donor Database Choose a Constituent Relationship Management (CRM) Program. Create Donor Profiles. Standardize Data Entry. Inform Development Efforts. Report on Performance for Internal and External Stakeholders. Reconnect With Inactive Donors or Volunteers. Customize Your Asks. How do you account for inventory donations? Recording a donation of products or inventory Once you know the FMV of the items, create an: Invoice for the donated products or inventory. Expense account for donations. Accounting entry that represents the donated inventory as a “charitable contribution” How do I set up online donations? 9 Steps to Collect More Online Donations [2022] | Donorbox Create a donation form. Set up a crowdfunding page. Enable recurring donations. Add a peer-to-peer fundraising option. Encourage company gift matching. Create urgency with a goal meter. Launch a text-to-give campaign. Make online giving simple and quick. Is there an app to track donations? ItsDeductible is an easy way to keep track of your donations and get back the maximum deductions you deserve for your charitable acts.

2025-04-12Yeah...you are just having trouble seeing where to import...see the pictures below that will get you to the WHOLE MENU of items on the Deductions & Credit page.BUT......Note for Online Software Users: IF your ItsDeductible account has a UserID that is different from the UserID you are using for your tax account, then, when you attempt to download your ItsDeductible data , it will either... a) not find an account, or.... b)...perhaps open the ItsDeductible file that does have the same UserID, but it's not the one that you used to store your 2016 data in.______________________________While the early releases of the software appeared to indicate that you can import ItsDeductible data from an account with a different UserID, that option is currently not working and may not be allowed this year. Going forward, should you decide to continue to use ItsDeductible, I would encourage you to only record your ItsDeductible donations in an account that has the same UserID as your tax account. Unfortunately, this is going to cause you extra manual entry work this year, putting your donations directly into the tax software, unless you want to wait a month or two to see if TTX developers or management decide to change it.....no promises that they will.(Desktop software users do not have this limitation) ____________*Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or official tax advice.*

2025-04-09Computers with Causes Welcomes You! Help Those Less Fortunate donate a computer today! Donating a computer, gadget or tablet is simple and fast. Call us 888-228-7320 or fill out our very easy Computer Donation form. With your generous donation, individuals and corporate donors receive a tax deduction. Donate a Computer and write it off on your taxes! Business donors can deduct the undepreciated value of the computer, and individuals can deduct the current market value of a computer. Tax Deductions Your donation helps the charitable programs we support, provides much needed educational and vocational assets, and substantially increases resources to support our communities. See Who Your Donation Helps Donate Today! Donate Laptop Computer (any brand - old or new) to Computers with Causes charity today! Tablet Donation - Apple Ipad, Samsung Galaxy Tab, Microsoft Surface Pro, Lenovo, Asus etc. Donate Desktop Computers - Apple, HP, Dell, Corsair, Acer, Lenovo, IBuyPower, MSI etc. Donate Server, Clients & Terminals - IBM, Fujitsu, Cisco, Dell Poweredge, HP Proliant, Sun Oracle etc. Donate Gadgets - 3D printer, security and digital cameras, robots, drones, VR headset, machinery etc. Donate your used, excess, and surplus bulk hardware for a Current Market Value Tax Deduction Computers with Causes is a 501c3 Nonprofit Our computer donation program participates in a zero-waste recycling program. New and used computer donations appreciated. All charity computer donations, gadgets and tablet donations are tax deductible and support worthy charitable causes! Feel free to contact us with any questions.Our highly effective charitable computer donation program produces a meaningful impact on the quality of life for thousands of people every year throughout the world! Why Donate Your Computer? Help Others One of the greatest reasons to donate to charity is to help the less fortunate. If you have been blessed, making a decision to donate to charity can help you give a little back. Make a Difference Our main goal is to provide a refurbished computer from one of our many generous donors towards an educational, needy individual, or future learning program. Fair Market Tax Deduction When you donate computer you will gain certain tax benefits. All of us are looking for ways to pay less money in taxes. We go the extra mile to guarantee a write-off. Your computer donation may end up helping those who need it the most! Support students, teachers, and parents, foster homes, shelters, elderly or community center in the

2025-04-01WordPress. Offering a seamless experience for those seeking a simple donate button or a robust donation platform. This plugin transforms the way online donations are accepted, providing customizable forms, detailed donor data, and insightful fundraising reports. Whether you're a charity or an individual, GivеWP caters to your needs with its user-friendly features.Creating forms is a breeze with the Visual Donation Form Builder, inspired by Gutenberg blocks. The builder allows real-time customization, adding goals, multiple giving amounts, and more with just a few clicks. Actionable fundraising reporting ensures you have a detailed breakdown of donation activities. While complete donor management features enable you to generate tax-deductible receipts and provide donors with a personalized dashboard.With over 100,000 active installs, GivеWP has success stories from various causes, nonprofits, and even individual endeavors. It's your go-to WordPress donation plugin for simple and pain-free giving, seamlessly integrating with various payment processors. Whether you're a nonprofit organization or an individual with a cause, GivеWP empowers you to raise funds effectively. Elevate your WordPress website with GivеWP – the WordPress plugin that combines simplicity with powerful features for online giving.3. Donation Platform For Woocommеrcе Turn your WooCommerce platform into a powerful fundraising hub with Donation Platform for WooCommerce. Elevate your charity or fundraising efforts effortlessly by unlocking the potential of WooCommerce's diverse ecosystem. This free and open-source plugin offers a range of features, from recurring donations and modern designs to automated donation receipts and support for over 100 payment gateways. Express donations via Apple Pay, Google Pay & PayPal ensure a hassle-free giving experience, and this plugin allows donors to cover transaction costs, maximizing contributions.Moreover, the Donation Platform for WooCommerce is not just a fundraising solution; it's a versatile tool suitable for charities, non-profit organizations, individuals, and political fundraisers. The beautiful design, mobile optimization, and advanced donation

2025-04-01